|

Getting your Trinity Audio player ready...

|

Asset tokenization is transforming how value is created, distributed, and accessed across industries. By converting real-world assets into digital tokens on a blockchain, businesses and investors are exploring new ways to unlock liquidity, lower entry barriers, and streamline transactions. This innovative approach is not limited to financial instruments—it now spans real estate, intellectual property, environmental assets, and even subscription models.

In 2025, the asset tokenization market is projected to reach a valuation of $2.08 trillion, with expectations to grow at a CAGR of 45.46%, hitting $13.55 trillion by 2030. In addition, real-world asset (RWA) tokenization has already surpassed $50 billion in on-chain assets and is forecasted to reach $500 billion by the end of 2025.

As technological integration accelerates and regulatory landscapes evolve, tokenization is steadily gaining traction among traditional institutions and digital-first ventures alike. In this piece, we will discuss asset tokenization, its applications, benefits, and challenges. We will also examine asset tokenization trends and opportunities.

Let’s Get Your Assets on the Blockchain

Got real estate, equity, or collectibles? We’ll help you turn them into digital tokens that live on the blockchain. Safe, legal, and done right.

What is Asset Tokenization?

Asset tokenization is the act of transforming ownership rights in a real-world asset into a digital token using blockchain. These tokens are shares on real or intellectual property that can be bought, sold, or (as the case may be) warehoused, similar to securities as we know them today. This model introduces enhanced efficiency in asset management, improved access to investment opportunities, and stronger security with cryptographic validation.

At its core, asset tokenization is the confluence of finance and technology that provides a defined route to unlock liquidity and democratize access to high-value assets.

Benefits of Asset Tokenization

The growing relevance of asset tokenization lies in its ability to transform global finance by addressing longstanding inefficiencies. Here are five key benefits:

1. Enhanced Liquidity

Tokenization converts traditionally illiquid assets, like real estate or collectibles, into tradable digital tokens, significantly improving market liquidity. Investors can easily buy or sell fractional ownership, enabling quicker transactions, broader participation, and reduced holding periods, especially in previously inaccessible markets.

2. Greater Accessibility

By lowering entry barriers, tokenization democratizes investment opportunities. Tokenization companies play a key role in enabling retail investors to access high-value assets through fractional tokens, allowing participation in markets historically reserved for institutional players.

This broadens the investor base and supports inclusive wealth generation across socioeconomic and geographic boundaries.

3. Increased Efficiency and Transparency

Blockchain infrastructure reduces intermediaries and automates verification, significantly cutting costs and time delays in asset transfers. Every transaction is immutably recorded, enhancing traceability and auditability. This fosters trust between participants and promotes operational efficiency across sectors using tokenized assets.

4. Fractional Ownership and Diversification

Tokenization allows assets to be distributed into smaller, tradable units. Investors can expand their portfolios by holding fractions of multiple asset types rather than committing to a single large investment. This lowers individual risk exposure while enhancing flexibility in asset allocation strategies.

5. Global Market Reach

Digital tokens can be traded globally on blockchain platforms, eliminating geographical restrictions. Asset owners gain access to a wider pool of investors, while buyers can explore international opportunities. This cross-border capability expands market reach, driving liquidity, valuation growth, and new business models.

What Can Be Tokenized?

Asset tokenization is not restricted to any single class—it spans across resources, equities, services, and funds.

1. Resources

Natural and physical resources—like oil, gold, timber, and minerals—can be tokenized to facilitate fractional investment and real-time tracking. For instance, gold tokenization allows investors to digitally trade and hold fractional ownership of physical gold, enhancing accessibility and liquidity. This approach enables global access, enhances supply chain transparency, and unlocks liquidity in traditionally capital-intensive sectors, benefiting producers, investors, and consumers through digital tradability.

2. Equity

Company shares and private equity can be digitized into tokens, streamlining fundraising, reducing administrative overhead, and enabling broader investor participation. Tokenized equity supports faster settlements, real-time cap table updates, and access to secondary markets, helping startups and enterprises raise capital more efficiently and inclusively.

3. Funds

Investment vehicles like mutual funds, ETFs, or hedge funds can be tokenized to allow fractional ownership, greater transparency, and 24/7 trading. This opens up fund participation to a broader investor base and improves liquidity while simplifying compliance, reporting, and asset distribution processes across jurisdictions.

4. Services

Professional services—legal consultations, digital subscriptions, or event access—can be tokenized into utility or access tokens. This creates flexible, secure, and verifiable methods for service delivery, microtransactions, and customer engagement, especially in sectors like entertainment, education, and consulting, where usage-based billing is essential.

Related Blog: What is tokenization

Emerging Technologies Shaping Asset Tokenization

1. Blockchain and Distributed Ledger Technology

Blockchain provides the decentralized, tamper-proof infrastructure needed for secure and transparent token issuance, trading, and ownership tracking. Distributed ledger technology (DLT) enables real-time data sharing across participants, reducing reliance on intermediaries and supporting verifiable, auditable records, which are key for building trust in asset tokenization systems.

2. Smart Contracts and Their Role in Asset Tokenization

Smart contracts automate asset transfer, dividend payouts, and compliance checks by executing pre-defined rules without manual intervention. This reduces administrative costs, improves transaction speed, and ensures enforcement of terms. They enable programmable, trustless transactions across tokenized assets and marketplaces.

3. Integration of Artificial Intelligence and Machine Learning

AI and ML enhance risk assessment, pricing models, and fraud detection in tokenized asset ecosystems. These technologies support smarter decision-making by analyzing large datasets, optimizing asset valuation, and predicting market behavior, making tokenized markets more resilient, efficient, and adaptive to dynamic economic conditions.

New Market Opportunities in Asset Tokenization

1. Tokenization of Carbon Credits and Environmental Assets

Organizations can tokenize carbon credits and renewable energy assets, making environmental investments more transparent, traceable, and tradeable. Credit carbon tokenization enhances carbon offset tracking, enables global participation in sustainability markets, and supports ESG-driven investment models aligned with regulatory and environmental goals.

2. Turning Subscription Plans Into Tokens

Businesses can tokenize recurring services—like streaming, SaaS, or fitness memberships—allowing users to trade, transfer, or resell subscriptions as digital tokens. This increases flexibility for users, generates new revenue models for providers, and transforms static service access into dynamic, marketable assets.

3. Turning Ideas and Content Rights Into Tokens

Intellectual property—books, music, patents, or designs—can be tokenized to represent ownership or licensing rights. This streamlines royalty distribution, ensures transparent usage tracking, and opens monetization channels for creators, empowering them to reach investors directly and retain more control over their work.

4. Converting Investment Funds Into Tokens

Tokenized funds offer instant fractional access to pooled investments such as venture capital, real estate, or hedge funds. Investors benefit from improved liquidity, transparent reporting, and easier secondary trading. At the same time, fund managers gain broader access to global capital without traditional restrictions.

5. Sharing Collectibles and Art Through Tokens

High-value physical and digital collectibles—like art, vintage cars, or NFTs—can be divided into ownership tokens. This allows multiple investors to co-own rare items, increases liquidity, and enables global participation in markets previously dominated by elite buyers and traditional auction houses.

6. Converting School and Job Certificates Into Tokens

Educational degrees, certifications, and work credentials can be issued as tamper-proof digital tokens. This enhances verification, prevents fraud, and simplifies cross-border recognition. Institutions and employers can securely validate qualifications, while individuals maintain a portable, verifiable record of achievements.

7. Using Tokens for Fancy Goods and Clothes

Luxury fashion and high-end goods can be tokenized for ownership authentication, resale tracking, or even shared ownership. This boosts consumer confidence in product authenticity, reduces counterfeiting, and introduces innovative ways to access, trade, or invest in premium consumer items.

8. Tokens for Sports and Entertainment

Clubs, athletes, and media brands use tokens for fan engagement, merchandise access, or profit-sharing. Tokenized ticketing, royalties, and brand rights create new revenue streams while deepening audience interaction, allowing fans to invest in the success of their favorite teams or entertainers.

Key Sectors Embracing Asset Tokenization

Industries with complex asset structures or high-value inventories are rapidly adopting tokenization:

1. Real Estate

Tokenization allows properties to be divided into fractional ownership units, enabling global investors to access high-value assets with lower capital requirements. Real estate tokenization platforms make this process more accessible by simplifying property transactions, enhancing liquidity in traditionally illiquid markets, and opening new financing channels for developers while providing diversified portfolio options for investors.

2. Art and Collectibles

Tokenizing fine art, rare items, and digital collectibles is redefining ownership and market participation. With blockchain-backed transparency and 24/7 trading potential, even small investors can now access previously elite markets. This shift creates a more inclusive ecosystem for creators, collectors, and forward-thinking investors.

3. Intellectual Property

Turn IP rights into smart, tradeable tokens that attract global backers and streamline royalty payments. Whether you’re a tech founder, author, or musician, tokenizing your rights gives you control, liquidity, and a clearer path to funding. It also helps investors tap into the value of ideas with confidence.

4. Commodities

Gold, oil, and agricultural resources can be securely tokenized, creating a more transparent and accessible marketplace for buyers worldwide. Tokenization reduces friction in trade, offers real-time settlement, and allows stakeholders to track ownership and supply chain movement through blockchain-enabled systems, improving efficiency across commodity sectors.

5. Stocks and Equities

Tokenized shares offer round-the-clock trading, fractional entry, and seamless cross-border investment opportunities. This growing movement is bridging the gap between traditional equity markets and digital finance, allowing businesses to raise capital more efficiently while giving retail and institutional investors unprecedented flexibility and accessibility.

Trends in Asset Tokenization for 2025

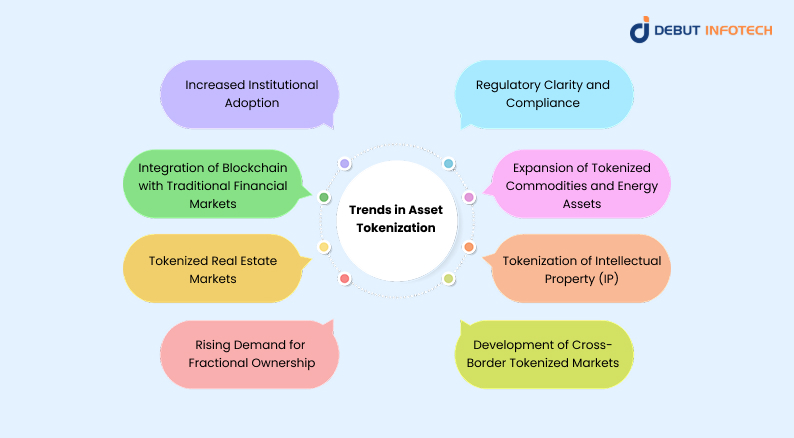

Here are some trends that will shape the future of tokenization:

1. Increased Institutional Adoption

Large financial institutions are accelerating their entry into asset tokenization, driven by maturing infrastructure and regulatory clarity. Banks and investment firms now view tokenized assets as credible, scalable investment vehicles. This shift bolsters market confidence and validates the long-term viability of tokenization as a mainstream financial practice.

2. Integration of Blockchain with Traditional Financial Markets

Legacy financial systems are increasingly integrating blockchain to streamline settlements, reduce costs, and unlock new revenue channels. In 2025, tokenized assets are expected to coexist with traditional instruments, blending innovation with familiar practices and creating hybrid models that make financial markets faster, more transparent, and more accessible.

3. Tokenized Real Estate Markets

More platforms are turning property into digital shares, letting investors own real estate without huge upfront costs. A real estate tokenization company typically facilitates this process, making global property investment easier, especially for younger and tech-savvy investors. For businesses, it opens new funding streams, reduces friction, and speeds up capital inflow.

4. Rising Demand for Fractional Ownership

Investors want more affordable ways to own high-value assets. Tokenization meets this demand by enabling fractional ownership in everything from art to infrastructure. In 2025, platforms offering micro-investment options are projected to rise sharply, transforming traditional asset classes into flexible, investor-friendly products.

5. Regulatory Clarity and Compliance

Regulatory agencies are moving toward clearer guidelines on digital asset issuance and trading. With well-defined compliance frameworks, businesses can build tokenized ecosystems more securely and at scale. This clarity also attracts institutional players previously deterred by legal uncertainty, thereby reinforcing trust in the token economy.

6. Expansion of Tokenized Commodities and Energy Assets

Energy firms and commodity traders are adopting tokenization to digitize oil, gas, and renewable energy credits. These tokens simplify global trading, lower overheads, and help trace assets through the supply chain. As this expands in 2025, expect easier access and new investors in traditional sectors.

7. Tokenization of Intellectual Property (IP)

Tokenized IP is giving creators and inventors new ways to monetize their work. Instead of waiting for lump-sum deals, they can now offer shares of future royalties or licensing income. In 2025, this trend is expected to grow across industries—tech, publishing, music, and entertainment.

8. Development of Cross-Border Tokenized Markets

Cross-border platforms are emerging to enable seamless international trading of tokenized assets. These systems reduce friction in compliance, currency exchange, and ownership verification. In 2025, more businesses are expected to issue tokens with global reach, broadening investor bases and supporting international liquidity in key sectors.

Challenges in Asset Tokenization Development

1. Regulatory Uncertainty

Many jurisdictions still lack clear legal frameworks for tokenized assets. This uncertainty discourages institutional participation and complicates compliance for startups. Without consistent global standards, projects risk delays, fines, or shutdowns. A harmonized regulatory environment is essential to foster investor trust and ensure widespread adoption of real world asset tokenization.

2. Security Concerns

Even though blockchain is secure by design, poor smart contract coding, exchange vulnerabilities, or weak custody solutions can expose tokenized assets to hacks. Businesses must invest in rigorous cybersecurity, conduct audits, and educate users. Securing tokenized systems is key to protecting investor funds and long-term platform credibility.

3. Scalability Issues

Public blockchains often struggle with transaction throughput and network congestion. As tokenized markets grow, tokenization platforms need solutions that support high volumes without sacrificing speed or affordability. In 2025, scalable infrastructure, like Layer 2 protocols or sidechains, is critical to enabling broader use of tokenized assets across sectors.

4. Liquidity Constraints

Tokenized assets still face limited secondary market activity, which can trap capital and reduce investor appeal. Without reliable platforms and buyer demand, converting tokens into cash is difficult. Overcoming this challenge requires better trading platforms, increased institutional support, and cross-border interoperability to deepen liquidity pools.

5. Lack of Standardization

The asset tokenization ecosystem lacks uniform technical and legal standards. This creates friction when transferring tokens across platforms or regions. Standardized protocols, taxonomies, and compliance rules are essential for interoperability. In 2025, collaborative industry efforts are underway to establish frameworks that support secure, scalable growth.

Need a Plug-and-Play Tokenization Platform?

Want your own setup but don’t wanna build from scratch? We’ve got white-label platforms that you can slap your name on and launch quickly.

Conclusion

Asset tokenization isn’t just a future trend. It’s a present-day reality shaping the foundations of global trade, investment, and ownership. By adopting tokenization strategies, businesses can open doors to global capital, enhance asset liquidity, and offer more inclusive access to high-value opportunities.

From tokenized carbon credits and art to digitized certificates and intellectual property, the potential to reshape markets is expansive and tangible. The key lies in staying informed, adapting to evolving regulatory frameworks, and leveraging blockchain and smart contract technologies effectively.

For forward-thinking organizations, tokenization offers a competitive edge and a scalable path toward sustainable growth, transparency, and innovation in 2025 and beyond.

FAQs

A. According to a 2022 Boston Consulting Group (BCG) and ADDX report, asset tokenization is projected to grow 50 times to reach $16.1 trillion by 2030, representing 10% of global GDP. This growth is driven by the increasing adoption of blockchain technology across various asset classes.

A. Tokenizing an asset can cost anywhere from $5,000 to $100,000 or more, depending on the asset type, platform used, legal setup, and complexity. Real estate, for example, might be pricier due to compliance requirements. Some platforms offer cheaper packages, but they come with fewer services.

A. While tokenization sounds cool, it’s not risk-free. There’s regulatory uncertainty, smart contract bugs, a lack of buyer demand, and potential liquidity issues. Plus, if the platform you’re using goes down, so could your investment. It’s smart to research well and get legal advice before diving in.

A. Start by picking the asset—real estate, art, equity, etc. Then, choose a reliable tokenization platform, consult a legal advisor, and set up a smart contract. After that, you issue the tokens and list them on a marketplace. It’s not plug-and-play, but it’s doable with the right help.

A. Tokenization is turning a real-world asset into digital tokens on a blockchain. For example, owning a $500,000 building can be split into 1,000 tokens worth $500 each. Investors can buy those tokens, making ownership easier, faster, and more flexible. It’s like fractional shares, but for physical stuff.