|

Getting your Trinity Audio player ready...

|

The financial services industry is undergoing a rapid transformation fueled by innovative technologies. While blockchain has demonstrably disrupted various sectors, the payments landscape has only recently begun to capitalize on its full potential.

As the world embraces cashless economies, new digital payment methods are emerging, with blockchain in payments taking center stage. This burgeoning market is poised for explosive growth, with Grand View Research predicting a market size of USD 1,431.54 billion by 2030.

Fueling this growth is the increasing adoption of blockchain for cross-border transactions. Juniper Research estimates that the total value of B2B cross-border payments stored on blockchain will reach $4.4 trillion by 2024, highlighting its potential to revolutionize secure and efficient international payments.

This piece will delve deeper into the core principles of blockchain technology and its impact on payment systems, exploring the benefits it offers and its future as a major player in the global financial landscape.

Understanding Blockchain Technology

Blockchain is a digital ledger technology that records transactions in a series of interconnected blocks. Each block contains time-stamped records of transactions or data exchanges, and these blocks are distributed across a network of computers.

A unique cryptographic hash identifies each block, which also includes the hash of the previous block, creating a secure, interlinked chain. When a new transaction occurs, it is added as a new block after being validated by all network nodes through consensus mechanisms such as Proof of Work or Proof of Stake. Blockchain’s transparency and security make it particularly advantageous for the payments and finance industry.

Given these properties, blockchain provides a robust framework for secure, transparent, and efficient transactions, making it a perfect fit for transforming payment systems. Now, let’s explore how blockchain in payments works and the specific benefits it provides.

How Blockchain Works in Payments

Blockchain technology revolutionizes payment systems by providing a secure, transparent, and efficient method for handling transactions. Blockchain payment systems utilize a decentralized ledger to record transactions across a network of computers, eliminating intermediaries, reducing transaction costs, and enhancing security.

The process begins with the creation of a transaction. A user initiates a transaction by sending a request to the blockchain network. This request is then broadcast to a network of nodes, which validate the transaction using consensus mechanisms such as Proof of Work (PoW) or Proof of Stake (PoS). Once validated, the transaction is combined with others to form a new block.

Validation and confirmation involve all network nodes coming to a consensus on the transaction’s validity. After consensus is reached, the new block is added to the existing blockchain. Each block contains a unique cryptographic hash and the hash of the previous block, ensuring the chain’s integrity.

Recording the transaction on the blockchain ensures immutability and transparency, as the ledger is updated across all nodes in the network. Smart contracts further enhance blockchain payments by automating transactions based on predefined conditions, making the process more efficient and reliable.

By integrating these elements, blockchain technology provides a robust framework for modernizing payment systems, ensuring security, transparency, and efficiency.

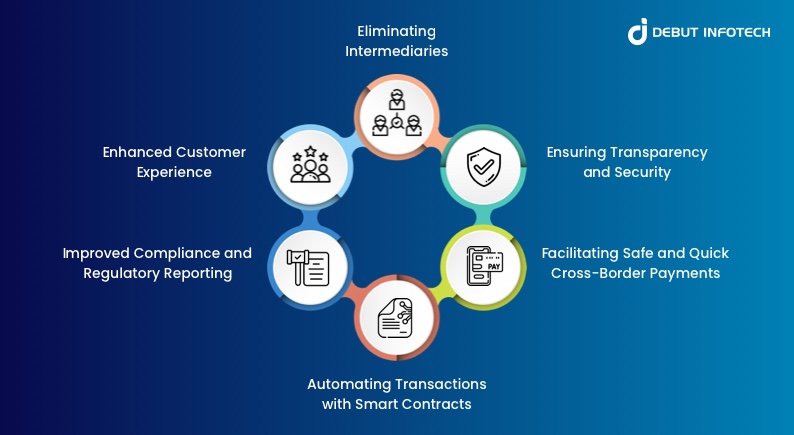

Advantages of Blockchain in Payments

Blockchain technology has significantly transformed the landscape of payment systems, offering a host of advantages that cater to the evolving needs of the financial industry. These benefits include enhanced security, faster transaction times, lower costs, increased transparency, and decentralization.

Let’s delve into each of these advantages to understand how blockchain is revolutionizing payments.

- Eliminating Intermediaries

Traditional payment systems rely heavily on numerous intermediaries and authorizations, such as payment gateways, exchange modes, and issuers. While these intermediaries ensure the authenticity of payments, they have significant drawbacks: they charge for their services, which increases transaction costs, and they slow down transaction times.

Blockchain payment systems, on the other hand, eliminate the need for these middlemen. Transactions can be settled more easily and authentically through peer-to-peer transfers. This means users can maintain transaction integrity, securely store transaction data, and quickly develop and use cryptocurrency wallets for payments. Banks, too, are recognizing these benefits, incorporating blockchain transactions to simplify and speed up their processes, eliminate intermediaries, and enhance transparency and security.

- Ensuring Transparency and Security

One of the standout features of blockchain technology is its high level of transparency. Every transaction made through a blockchain network is stored on the blockchain, making it immutable and visible to all participants. This ensures that transaction records are securely saved and that data integrity is maintained without the need for external record-keeping.

Each block in a blockchain contains its own unique hash and the hash of the previous block, creating a chronological and tamper-proof chain. Any attempt to alter a record would be immediately noticeable, safeguarding the data against tampering.

- Facilitating Safe and Quick Cross-Border Payments

Cross-border payments have long been plagued by issues such as multiple intermediaries, high costs due to commissions, lengthy processing times, unclear data privacy regulations, and lack of transparency. Blockchain technology addresses these challenges effectively. It significantly reduces the number of intermediaries involved, which not only cuts costs but also ensures the authenticity of payments through transparency.

Blockchain enables funds to be transferred across borders quickly, reducing processing times from days to just a few hours. All transaction data on the blockchain is immutable, ensuring both the safety of payments and the privacy of information.

For example, using a blockchain platform like Stellar, a person in India can send money to a friend in the USA. The rupees are converted into Stellar Lumens (XLM), which are then sent across the blockchain. Once the transaction reaches the recipient’s side, the Stellar Lumens are converted back into US dollars, making the process swift and seamless while maintaining security and transparency.

- Automating Transactions with Smart Contracts

Smart contracts offer significant advantages, particularly for businesses. They automate payment flows, facilitating instant payments once predefined conditions are met. This reduces payment times and ensures that transactions are carried out efficiently.

For example, consider a real estate transaction. A smart contract can be set up between a buyer and a seller, where the contract automatically releases funds to the seller once all the necessary legal documents are submitted and verified. This automation not only streamlines the process but also eliminates the need for intermediaries like escrow agents, ensuring a quicker and more secure transaction.

- Improved Compliance and Regulatory Reporting

Blockchain technology also enhances compliance and regulatory reporting. By providing an immutable and transparent record of all transactions, blockchain makes it easier for financial institutions to comply with regulatory requirements. The real-time data available on the blockchain allows for better monitoring and auditing, reducing the risk of non-compliance and ensuring that financial transactions adhere to legal standards.

Moreover, the traceability of transactions on the blockchain enables more efficient reporting and auditing processes. Regulators can easily track and verify transaction histories, which simplifies compliance checks and reduces the time and resources spent on regulatory reporting.

- Enhanced Customer Experience

Another significant advantage of blockchain in payments is the improvement in customer experience. With faster transaction times, reduced fees, and enhanced security, customers benefit from a more efficient and reliable payment process. Blockchain’s ability to provide real-time transaction status updates and instant confirmations increases customer satisfaction and trust in the payment system.

Additionally, the elimination of intermediaries means fewer points of failure and reduced risk of transaction errors, further enhancing the overall customer experience. As a result, businesses that adopt blockchain technology can offer a superior service to their customers, gaining a competitive edge in the market.

Now that we understand how blockchain is transforming the traditional financial sector with its innovative payment systems, let’s delve into various key use cases of blockchain-based payment systems to see how they are applied in real-world scenarios. By exploring these use cases, we can better appreciate the full potential and practical benefits that blockchain technology brings to the payments industry.

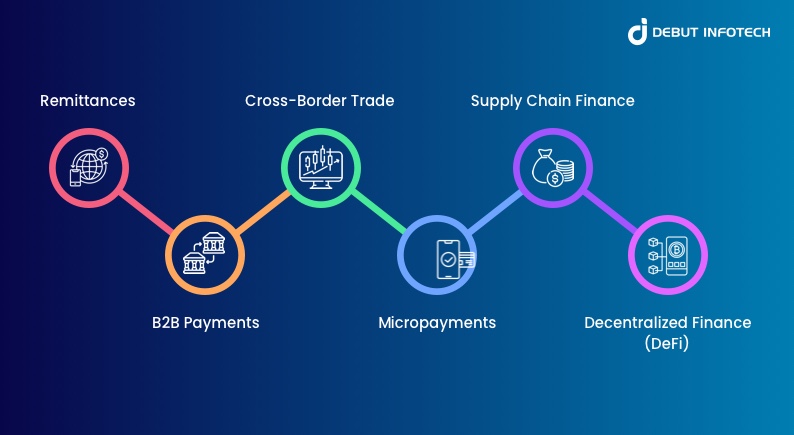

Key Use Cases of Blockchain-Based Payment Systems

Blockchain in digital payment systems are transforming financial transactions by enhancing security, transparency, and efficiency. Key applications include remittances, B2B payments, cross-border trade, micropayments, supply chain finance, decentralized finance (DeFi), and loyalty programs. These use cases demonstrate blockchain’s capacity to streamline operations and elevate financial services across industries.

Let’s delve deeper into these applications.

- Remittances

Blockchain payment solutions have significantly improved the process of sending remittances across borders. Traditional remittance services are often expensive and slow, but with blockchain payments, individuals can send money to family and friends in other countries quickly and at a lower cost. For instance, blockchain payment companies like Ripple and Stellar enable near-instantaneous transfer of funds with minimal fees, making it easier for people to support their loved ones abroad.

Example: MoneyGram has partnered with Ripple to leverage its blockchain technology for faster and cheaper cross-border payments. This partnership has allowed MoneyGram to significantly reduce the costs and time associated with international transfers, enhancing customer satisfaction and expanding their service reach.

- B2B Payments

Businesses benefit from blockchain payment systems through faster and more secure B2B transactions. Traditional B2B payments often involve multiple banks and can take days to process. Blockchain payment methods streamline this process by enabling direct transfers between businesses, reducing the time and cost involved. Smart contracts also play a role here, automating payment flows and ensuring that transactions are executed only when certain conditions are met.

Example: IBM Blockchain enables businesses to make secure and efficient B2B payments, significantly reducing transaction times and costs. With IBM Blockchain, companies can conduct real-time transactions, improve cash flow management, and reduce the risk of fraud.

- Cross-Border Trade

Blockchain for payments facilitates smoother cross-border trade by reducing the complexities associated with currency conversion and international transactions. It eliminates the need for intermediaries, which reduces costs and processing times. For example, blockchain-based payment systems can handle transactions in multiple currencies, automatically converting funds and settling payments efficiently.

Example: TradeLens, a blockchain platform developed by IBM and Maersk, enhances cross-border trade by providing end-to-end visibility and reducing processing times. TradeLens has enabled more efficient customs clearance processes, reduced the risk of fraud, and improved overall supply chain efficiency.

- Micropayments

In the digital economy, blockchain in digital payments enables efficient micropayments for services and content. Traditional payment systems often charge high fees for small transactions, making them impractical. Blockchain’s low transaction costs make it feasible to pay for digital goods or services in small increments. This is particularly useful for industries like online gaming, content streaming, and digital publishing.

Example: Brave Browser uses blockchain to facilitate micropayments, allowing users to support content creators with small amounts of cryptocurrency. This model has provided a new revenue stream for creators and a privacy-focused browsing experience for users, where they are rewarded for their attention.

- Supply Chain Finance

Payment systems based on blockchain enhance supply chain finance by providing transparency and traceability. It allows all parties involved in a supply chain to view the same transaction data, ensuring that payments are made promptly and accurately. Smart contracts can automate payments to suppliers once goods are delivered and verified, reducing delays and improving cash flow.

Example: Walmart uses blockchain technology to track its supply chain, ensuring timely payments and transparency from farm to store. This has improved food safety by allowing for rapid traceability of contaminated products and has streamlined supplier payments, reducing disputes and improving efficiency.

- Decentralized Finance (DeFi)

DeFi platforms leverage blockchain transaction capabilities to offer financial services like lending, borrowing, and trading without traditional intermediaries. Users can earn interest on their crypto assets, obtain loans, and trade digital assets in a secure and transparent environment. DeFi is revolutionizing the financial sector by making financial services more accessible and efficient.

Example: Compound is a DeFi platform that allows users to lend and borrow cryptocurrencies, earning interest on their holdings through blockchain technology. Compound has democratized access to financial services, offering high-interest rates on deposits and transparent, algorithm-driven loan terms.

- Loyalty and Rewards Programs

Blockchain-based payment systems can streamline loyalty and rewards programs by recording all transactions on a transparent ledger. This reduces fraud and ensures that points or rewards are accurately tracked and redeemed. Blockchain-based loyalty programs can also allow for easy transfer and redemption of points across different platforms and partners.

Example: Singapore Airlines’ KrisFlyer loyalty program uses blockchain technology to provide a digital wallet for members to manage and spend their miles more efficiently. This has enhanced the customer experience by simplifying the redemption process and offering greater flexibility in how miles can be used.

By examining these use cases, it becomes clear that blockchain technology offers diverse applications that go beyond simple transactions. Its ability to enhance security, reduce costs, and streamline processes is driving its adoption across various sectors, heralding a new era in the financial landscape.

Challenges and Limitations of Implementing Blockchain in Payment Systems

While blockchain technology offers numerous advantages for payment systems, its implementation also comes with several challenges and limitations. Understanding these obstacles is crucial for organizations considering the adoption of blockchain-based payment solutions.

- Scalability

One of the primary challenges of blockchain technology is scalability. As the number of transactions increases, the blockchain network can become congested, leading to slower transaction times and higher fees. This limitation is particularly problematic for payment systems that require high transaction throughput. Solutions such as off-chain transactions and the development of more efficient consensus algorithms are being explored to address scalability issues.

- Energy Consumption

Blockchain networks, especially those using Proof of Work (PoW) consensus mechanisms, consume significant amounts of energy. This high energy consumption is a concern for both environmental sustainability and operational costs. Alternatives like Proof of Stake (PoS) and other consensus mechanisms are being developed to reduce energy usage, but these solutions are not yet universally adopted.

- Regulatory Uncertainty

The regulatory landscape for blockchain and cryptocurrencies is still evolving. Different countries have varying regulations, and in some cases, there is a lack of clear guidance. This uncertainty can create challenges for companies looking to implement blockchain-based payment systems, as they must navigate a complex and sometimes contradictory regulatory environment. Ensuring compliance with local and international regulations is a critical consideration for blockchain adoption.

- Integration with Existing Systems

Integrating blockchain technology with existing payment systems and infrastructure can be complex and costly. Organizations need to ensure that blockchain solutions are compatible with their current systems and can seamlessly integrate without disrupting ongoing operations. This integration often requires significant investments in technology and expertise, which can be a barrier for many companies.

- Security Concerns

While blockchain is inherently secure due to its decentralized and cryptographic nature, it is not immune to attacks. Issues such as 51% attacks, where a single entity gains control over the majority of the network’s computing power, can compromise the integrity of the blockchain. Additionally, vulnerabilities in smart contracts can be exploited, leading to financial losses. Continuous advancements in security protocols are necessary to mitigate these risks.

- User Adoption and Education

For blockchain payment systems to be successful, widespread user adoption is essential. However, many users and businesses are still unfamiliar with blockchain technology and its benefits. Educating stakeholders about how blockchain works and its advantages over traditional payment systems is crucial for driving adoption. Overcoming resistance to change and building trust in the technology are significant challenges.

- Cost

Implementing blockchain technology can be expensive. The initial setup costs, including hardware, software, and skilled personnel, can be substantial. Additionally, ongoing maintenance and upgrades add to the overall cost. For smaller organizations, these expenses can be prohibitive, limiting their ability to adopt blockchain solutions.

- Interoperability

Different blockchain networks often operate in silos, lacking interoperability with one another. This fragmentation can hinder the seamless exchange of information and transactions across different platforms. Efforts are being made to develop standards and protocols that facilitate interoperability, but achieving widespread consensus and implementation remains a challenge.

Now that we understand the challenges of blockchain in payment systems, let’s explore how organizations can implement blockchain payments to mitigate these issues and leverage the technology’s full potential for businesses.

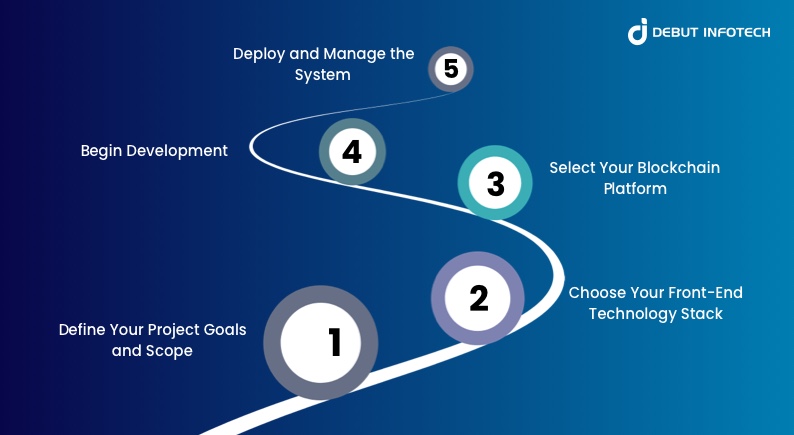

Steps to Implement Blockchain Based Payment System in Your Business

Implementing blockchain payments in your business requires a systematic approach. Here are the steps to ensure a successful integration:

Step1- Define Your Project Goals and Scope

The first step is to clearly define the project’s goals and scope. This involves:

- Objectives: Determine what you want to achieve with blockchain payments (e.g., reduce transaction costs, increase security, improve transparency).

- Requirements: Identify the functional and non-functional requirements of the system.

- Stakeholders: List all stakeholders involved, including developers, business managers, and end-users.

- Timeline: Establish a realistic timeline for each phase of the project.

- Budget: Determine the budget required for development, integration, and maintenance.

Step2- Choose Your Front-End Technology Stack

The front-end technology stack will determine how users interact with the blockchain payment system. Key considerations include:

- Frameworks: Choose appropriate frameworks (e.g., React, Angular, Vue.js) for developing the user interface.

- Libraries: Select libraries that facilitate blockchain interaction (e.g., Web3.js for Ethereum).

- APIs: Develop or integrate APIs that connect the front end with the blockchain back end.

- UX/UI Design: Focus on creating an intuitive and user-friendly interface to ensure a seamless user experience.

Step3- Select Your Blockchain Platform

Choosing the right blockchain platform is crucial for the project’s success. Considerations include:

- Platform Features: Evaluate the features and capabilities of platforms like Ethereum, Hyperledger Fabric, Stellar, and Ripple.

- Consensus Mechanism: Choose a consensus mechanism that suits your business needs (e.g., Proof of Stake, Proof of Work).

- Scalability: Ensure the platform can handle the expected transaction volume.

- Security: Assess the platform’s security features to protect against vulnerabilities.

4. Begin Development

Start the development phase by setting up the development environment and beginning the coding process. Key steps include:

- Smart Contract Development: Write and test smart contracts that automate transactions and ensure predefined conditions are met.

- Backend Development: Develop the backend infrastructure that supports blockchain operations, including nodes, databases, and servers.

- Integration: Integrate the front end with the blockchain platform using APIs and middleware solutions.

- Testing: Conduct rigorous testing, including unit tests, integration tests, and user acceptance tests, to ensure the system functions correctly.

5. Deploy and Manage the System

The execution phase involves deploying the system and monitoring its performance. Key activities include:

- Deployment: Deploy the blockchain payment system on a testnet for initial trials. Once stable, deploy on the mainnet.

- Training: Train staff and users on how to use the new system effectively.

- Monitoring and Maintenance: Continuously monitor the system for performance issues and security vulnerabilities. Regularly update and maintain the system to incorporate improvements and fix bugs.

- Feedback and Improvement: Gather feedback from users and stakeholders to identify areas for improvement and make necessary adjustments.

Implementing a blockchain payment system is a complex and technical endeavor that demands expert supervision for optimal efficiency. Therefore, it is advisable to engage a specialized blockchain app development company like Debut Infotech who assists in this process of ensuring a seamless and thorough implementation of the blockchain payment system.

What Blockchain-Based Payment Solutions Debut Infotech Offers?

At Debut Infotech, we offer comprehensive blockchain payment solutions designed to meet the needs of both enterprises and startups. Our team evaluates your project requirements, identifies the best payment solution for your needs, and initiates the development process.

We also provide customization for existing blockchain payment solutions through integrations, system modifications, and implementations. Our services related to decentralized payment solutions include:

- DeFi Solutions

We create secure and permissionless payment solutions for DeFi applications, including decentralized exchanges and crypto loan platforms. Leveraging blockchain technology, our solutions enable transparent and trustless financial transactions without intermediaries.

- P2P Lending Solutions

We develop and integrate blockchain payment solutions to facilitate auto-payments using smart contracts, enhancing the efficiency of peer-to-peer lending platforms. Our solutions eliminate intermediaries, allowing direct transactions between lenders and borrowers.

- NFT Marketplaces

Our trustless payment solutions empower buyers and sellers to make payments via crypto wallets. We can develop custom wallets from scratch or integrate ready-to-deploy wallets like MetaMask and Torus into NFT marketplaces. Our wallets support the storage, sending, and retrieval of funds for NFTs.

- Cryptocurrency Payment Gateways

We set up cryptocurrency payment gateways that allow businesses to accept various cryptocurrencies as payment. These crypto payment methods are secure, efficient, and easy to integrate into existing e-commerce platforms, enabling smooth and transparent transactions.

End Note-

The future of payments is undoubtedly intertwined with the evolution of blockchain technology. While challenges remain, ongoing advancements are paving the way for a more secure, efficient, and transparent financial landscape. As blockchain adoption continues to accelerate, we can expect to see its transformative impact ripple across industries, revolutionizing the way we conduct financial transactions.

Are you ready to explore how blockchain payments can empower your business?

Debut Infotech is your trusted partner in navigating the world of custom blockchain development solutions. We offer comprehensive blockchain payment solutions tailored to your specific needs, from consulting and development to integration and ongoing maintenance. Contact us today to schedule a consultation and discover how blockchain can unlock a new era of financial efficiency and security for your organization.