In every way, Defi has emerged as an oversaturated industry, relying on the ability to crowdsource more funds by launching hundreds of projects in a single space with no discernible controls. Lending protocols, decentralized marketplaces, and yield farming platforms abound. These days, the main goal of any newly created Defi project is to differentiate itself from the competition in any way possible. Speaking of the Injective Protocol, it has a project that uses a scalable and decentralized methodology to target the derivatives market. Given support from prominent industry players, including Pantera, Binance, and CMS, it is hard to dismiss a team that promises unrestricted access to DeFi marketplaces with zero constraints.

What is Injective Protocol?

Injective Protocol is a layer-2-backed decentralized derivatives exchange founded in 2018 by Eric Chen and Albert Chon. It runs on Ethereum. With the help of this injective protocol system and layer-2 solution backup, investors can access DeFi marketplaces securely and on time. In April 2020, Injective Labs debuted its first product—the first fully decentralized exchange system in DeFi. The programming team’s primary goal was to overcome the limitations imposed by the DEXs at the time, which kept users in check by relying on order book trading, high latency, inadequate liquidity, and other centralized features.

Injective stands apart from the conventional blockchain types—application-specific and generalized—because it specializes in the DeFi industry. Blockchains dedicated to an application address a specific use case by offering resources and features to make it easier to develop and implement DApps in a given domain. These blockchains frequently show increased efficiency and performance but at the price of less adaptability. Conversely, generalized blockchains are designed to accommodate many applications, giving developers flexibility and adaptability. However, certain costs could be associated with this universality, including more complexity and decreased efficiency. This answers the question: what is inj coin?

Injective stands out from other blockchain platforms because it focuses on resolving the issues and constraints common in DEXs and the DeFi domain. Conventional DEXs frequently have problems with low liquidity, high latency, a narrow range of products, and inefficient capital. With its end-to-end decentralized platform for spot trading, margin, futures, and perpetual swaps, Injective seeks to address these problems. The core of the blockchain is resistance to front running, public verifiability, censorship, and trustlessness. The frequent batch auction (FBA) model for transaction processing, which Injective uses in its novel approach, promotes a trading environment with tighter spreads and higher liquidity nearer the market price.

What is The Motive Of The Injective Protocol?

The Injective Protocol envisions a decentralized, recently built economy. Creating a more secure and private exchange, payment, and remittance system is the vision’s motto. Hence, Injective develops a system that facilitates cryptocurrency trading, turning the technology into a decentralized public utility. Injective Protocol’s cryptocurrency exchange solution has helped customers by providing them and their community with the necessary value in the exchange scene. With injective technology, cross-chain blockchain-based forex trading, dApp development, futures, and derivatives allow participation from anybody and everyone worldwide.

With the aid of technological advancements, Injective Protocol is developing an exchange model that has the potential to completely revolutionize the market by accelerating the pace of trade execution and settlement in a decentralized, efficient manner free from censorship or permission.

The INJ cryptocurrency

The main goal of the INJ token’s design is to encourage users to participate in the platform’s development.

Its many uses are governance, staking, transaction fee payment, liquidity attraction, and rewards. By staking their tokens and offering liquidity, INJ holders can get passive income in addition to having a say in choices on important platform features. Utilizing INJ tokens for these many functions eventually helps the platform become more widely used and fosters the growth of a vibrant ecosystem. The injective protocol price has been in a healthy range between $29 and $44in the past 30 days.

What Solutions Does The Injective Protocol Provide?

The Injective Protocol is a technology designed to address the issue of third parties participating in transactions by generating the appropriate sequence that allows orders to be fulfilled safely and without any obstacles to collision. In addition to removing the necessity for a third party to match trade orders inside the same block, the invention was designed to maximize the benefits of DEX liquidity. Additionally, thanks to technology, participants can choose an order without knowing the specifics of other traders’ orders. This will ensure that there is no front-running and that many more orders can be filled without problems.

Additionally, the Injective Protocol matches the aggregate agreement between the majority of DEX to provide liquidity by checking orders in a way that offers efficiency and flexibility.

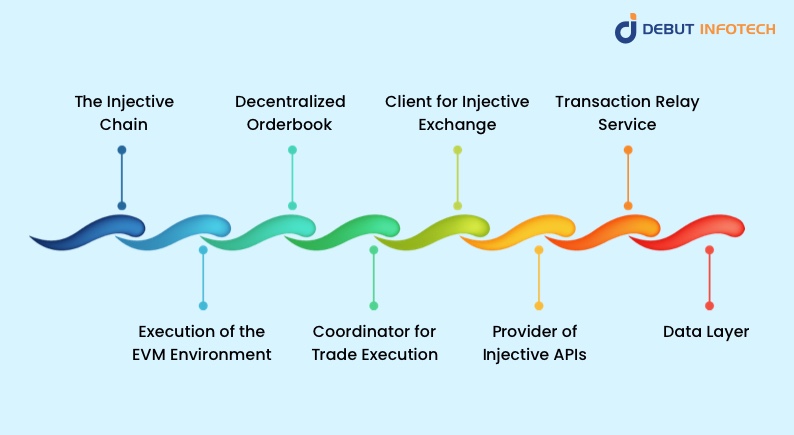

The Injective Chain

According to the Injective lab, the Injective Chain serves as the fundamental support structure for the Injective’s sidechain layer 2, which operates in connection with the Cosmos zone. The injective Chain also represents the project’s infrastructure. This architecture provides a reliable, decentralized means of powering next-generation defence applications. Injective Chain is a derivatives platform with a bidirectional token bridge to Ethereum, an order book, an EVM execution environment, and a trade execution coordinator. With the help of the cosmos-backed sidechain supporting EVM environments, Protocol to scale via L2 solutions, even though it delivers solutions on Ethereum, is achievable with the assistance of the Injective Chain.

Execution of the EVM Environment

The Injective Chain facilitates the extension of smart contract execution to the modular EVM implementation built on Cosmos SDK. After deploying EVM on top of Tendermint, users leverage a scalable and interoperable Ethereum implementation based on Proof-of-Stake with 1-block finality.

The contracts listed below are implemented on Injective EVM:

- Contracts for Injective EVM Bridges

- Staking Agreement

- Contract for Injective Coordinators

- 0x V3 Exchange Contracts

- Contracts for Injective Derivatives

- DEX Injectable Contracts

Decentralized Orderbook

By definition, a decentralized orderbook is an Ox-based orderbook that is entirely decentralized and that enables sidechain order relaying through on-chain settlement—a decentralized implementation of the off-chain order relay, which is usually centralized. The decentralized exchanges, which are also the central limit order book, are the primary users of this order book. The nodes of the Injective Chain relay and store orders for spot and derivatives trading in addition to hosting a decentralized, censorship-resistant orderbook.

Coordinator for Trade Execution

Decentralized coordinator implementation based on the 0x coordinator specification. With injective TEC, front-running trade is made possible via Verifiable Delay Functions, allowing for lower-latency trading through soft cancellations.

Client for Injective Exchange

The comprehensive and user-friendly graphical user interface designed for both novice and expert users is known as the Injective Exchange Client. Relayers can host the client on a server so that users can communicate using the Protocol. Additionally, users can run local clients to communicate directly with Protocol. The Exchange Client Interface is deployed on the IPFS platform.

Provider of Injective APIs

Under the Injective paradigm, relayers in the Injective network receive rewards for sourcing liquidity. By competing to provide a better user experience, exchange providers are compelled to better service customers, expanding worldwide access to DeFi development.

There are two uses for injective API nodes:

- Service for Transaction Relay

- Layer of Data

Transaction Relay Service

While broadcasting a conforming Tendermint transaction encoding a compatible message type allows users to communicate directly with the Injective Chain, this would be impractical for most users. A minimal HTTP, gRPC, and Websocket API is provided by API nodes to assist users in interacting with the Protocol. The required transactions are then created by the API nodes and sent to the Injective Chain.

Data Layer

External clients can use nodes of the Injective Exchange API as a data layer. Right out of the box, Injective’s sample frontend interface is compatible with its data and analytics API.

The Injective Derivatives and Spot Exchange APIs, 0x Standard Coordinator API, Injective Derivatives Protocol Graph Node GraphQL API, and other API services are required for the Injective Client. The Injective API supports all Injective Exchange Clients.

How Debut Infotech Can Help You Scale Up With Injective Protocol

Debut Infotech has a team of blockchain engineering professionals who can deliver top-tier blockchain development services like cryptocurrency exchange development, smart contracts and other DeFi dApps. Some of them include

Development of Smart Contracts

We offer services for creating solidity smart contracts on the Injective Protocol platform. While the INJ token unites the whole Injective Protocol platform, several Ethereum-based smart contracts comprise the fundamental protocol interactions and the token economy of the Injective network, including,

- Contracts for Injective Coordinators

- Staking Contracts

- Injective Futures Contracts

- Contracts for Injective Bridges

- Contracts with Injective Tokens

dApp Development

For those wishing to work on and utilize the Injective Protocol for their organizational work system, Debut Infotech offers highly qualified developers with extensive dApp development experience in building industrial-grade decentralized apps based on the Injective Protocol platform. Our developers create a variety of dApps on top of the Injective Protocol and release them.

Nodes Configuration

The two main functions of the API nodes on the Injective Protocol are to serve as the Protocol’s data layer servers and to provide transaction relay services. Our expert blockchain engineers build and configure highly optimized nodes for the Injective Protocol platform.

Conclusion

By implementing decentralized swap contracts, which are everlasting and based on any arbitrarily chosen market, the Injective Protocol enables traders to engage with and build on a Blockchain. The Injective Protocol’s architecture is based on the account balance model, which records all public positions of the individual accounts. Order matching via the Injective Chain is done concurrently with applying the Injective Protocol’s fundamental logic to the on-chain smart contracts.

Frequently Asked Questions

A. With plans to add more cross-chain assets, create new derivative products, and create sophisticated trading tools, Injective has a bold roadmap to determine its future. This approach seeks to establish Injective as a market leader in the DeFi industry through constant innovation and the addition of new features.

A. The Injective Chain leverages Tendermint’s Byzantine Fault Tolerant (BFT) algorithm for a safe, decentralized platform for cross-chain trading of derivatives, FX, synthetics, and futures. An extraordinarily dependable and practical trading experience is ensured by selecting validators based on staked INJ tokens and tokens delegated by other users.

A. Injective’s architecture comprises four primary layers: Injective DApps and tooling, Injective Chain nodes, Injective API nodes, and Injective bridge smart contracts and orchestrator. Layer 1 Cosmos-based Injective Chain features an Ethereum Virtual Machine (EVM) compatible execution environment and enables cross-chain decentralized derivatives trading.

A. Injective is developing an end-to-end platform for perpetual swaps, futures, margin, and spot trading to address issues with DeFi and DEXs. It features a novel frequent batch auction approach for transaction processing that encourages tighter spreads and more liquidity nearer market prices.

A. Using the Cosmos SDK, Injective is a layer 1 blockchain created for DeFi applications of the future. In addition to providing a wide range of financial products and services, it addresses the shortcomings of well-known smart contract platforms by enabling safe, quick, and interoperable transactions over numerous networks.